The Monetary Policy Committee of the

Central Bank of Nigeria on Tuesday called on the Federal Government to

urgently evaluate the level of its domestic indebtedness and develop a

framework for settling these debts.

The committee, in a communique issued at

the end of its two-day meeting held at the headquarters of the CBN in

Abuja, warned that the huge government indebtedness to economic agents

had slowed down business activities.

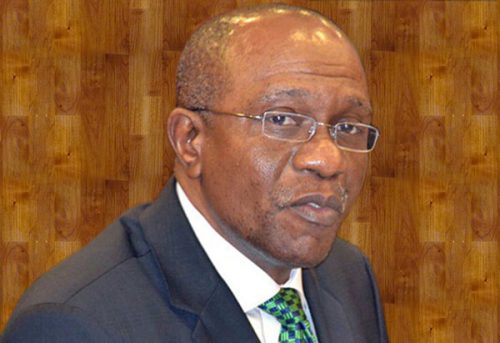

In the communique, which was read by the

CBN Governor, Mr. Godwin Emefiele, the committee noted that the

development was not good for the economy as it was compromising the

integrity of the financial system.

While reiterating that monetary policy

alone could not address the current economic crisis, the CBN governor

noted that the committee called for an enrichment of fiscal and other

sector initiatives and interventions towards resolving the growth

challenges in the economy.

He said these interventions were vital in order to promptly revive confidence in the economy.

Emefiele said, “Members stressed the

need for a robust and more keenly coordinated macroeconomic policy

framework that would restart output growth, stimulate aggregate demand

and rein in inflation expectations.

“The MPC urged the Federal Government to

urgently assess the extent of its indebtedness to domestic economic

agents and develop a framework for securitising the debts in order to

settle its outstanding domestic contractual obligations, which cut

across all sectors of the economy.

“These accumulated debts have slowed the

business activities of economic agents, most of who are indebted to the

banking system, thus compromising the integrity of the financial

system. It also advised the bank (CBN) to commit to greater surveillance

and deployment of early warning systems in managing the banking

system.”

The CBN governor said the committee

called on security agencies to sustain their checks on the activities of

illegal foreign exchange operators in order to bring sanity to that

segment of the market.

He said, “The extant foreign exchange

regulation outlaws the trafficking of currency on the streets as some

unlicensed operators currently do.

“Thus, to evolve an appropriate naira

exchange rate that stabilises the foreign exchange market, Bureau De

Change operators must strictly observe the terms and conditions of their

licences.”

On whether the CBN was supporting jail

terms for people hoarding dollars, Emefiele said the apex bank would not

support any such move.

He said while the current foreign

exchange regulations of the CBN did not in any way support jail term for

people who hoard dollars, he was aware that the Nigerian Law Reform

Commission was working towards reviewing the regulations.

The apex bank boss, however, added that the CBN would not support any move to prescribe jail terms for people who hoard dollars.

He said, “Let me use this opportunity to

reiterate that it is not in our foreign exchange regulations that

people should be jailed or their dollars confiscated. But I am aware

because just today (Tuesday), I was told that the Nigerian Law Reform

Commission is looking at reviewing the exchange regulations, just like

it normally will from time to time depending on the exigency of the

time.

“We have not been contacted regarding

whether or not some of the clauses that are involved are included in the

review to be conducted by the Law Reform Commission.

“But I am saying here categorically that

if we are contacted, or whenever it becomes an issue for discussion, we

will advise against a clause that forbids people from keeping their

dollars if they chose to, or a law that says people should be jailed for

keeping foreign currencies.”

When asked if the apex bank was

concerned about some of the risks facing the banking system owing to the

current economic crisis, the CBN governor admitted that while all

players in the financial system were facing “tremendous risks,” the

central bank would ensure that they would not crystalise to a point

where depositors’ funds would be lost.

He said, “As a result of the current

challenges being faced by the global economy, all agents in the

financial system, such as banks and other players, are facing tremendous

risks.

“When there is a slowdown or recession,

naturally banks will face certain risks such as non-performing loans

rising and different other risks, and this imposes on the regulator a

greater challenge to ensure that it strengthens its prudential

guidelines to ensure that the banks and particularly depositors are

protected.

“Nigerian banks, like other banks in

other climes, are facing risks. But those risks are surmountable, and

the central bank is doing all its best to ensure those risks don’t

crystalise to a point where we will begin to talk about depositors

losing their deposits. So for that reason, the rumour about banking

sector risks is overtly elevated.”

On whether the apex bank was considering

reducing the number of BDC operators so as to better regulate their

activities, the governor said the CBN might consider that option at the

appropriate time.

He said, “We believe that everybody

(BDC) is entitled (to have a licence) once the regulations are set;

there is no need to preclude you if you meet the conditions. But of

course, naturally, the regulator, which is the CBN, has a right to put

in place policies that limit entry. If we want to limit entry, we know

what to do.

“I can assure you we will do it anytime

we decide to limit entry or even exacerbate exit from the market, and

that is something we will look into at the appropriate time.”

On the foreign exchange inflow through

the CBN, the governor said the country recorded a decline of $447.5m or

31.85 per cent from $1.4bn in September to $957.37m in October.

He attributed the decrease to lower

crude oil and other government revenues in the period under review,

lamenting that despite the resumed Joint Venture payments in October,

the total outflows also continued to decrease.

Foreign exchange outflows, according to him, dropped significantly by 58.68 per cent from $2.25bn to $1.01bn during the period.

Emefiele said the committee implored the

CBN to continue to direct more focus at making foreign exchange

available to the agriculture and manufacturing sectors of the economy.

This, according to him, can be achieved

by enforcing its policy directing Deposit Money Banks to allocate 60 per

cent of the available foreign exchange to these sectors.

On the Monetary Policy Rate, the CBN governor said the committee decided to leave it unchanged at 14 per cent.

He explained that all the 10 members who attended the MPC meeting agreed to maintain the current monetary policy stance.

Apart from the MPR that was retained at

14 per cent, the governor said the committee also voted to retain the

Cash Reserves Ratio at 22.5 per cent.

Also retained were the liquidity ratio,

which was left at 30 per cent; and the asymmetric window, which was left

at +200 and -500 basis points around the MPR.

No comments:

Post a Comment